All of us must have heard scholar economists in news channels discussing inflation several times. They all discuss how to reduce the rate of inflation.

But do we all really know about inflation?

If expressed in simple terms, then we can understand the meaning of inflation as costliness because inflation has a direct effect on costliness.

"Permanent and temporary increase in the price of goods and services is called inflation."

For example, suppose 10 people each have Rs 100 to spend. The shopkeepers who have only enough 100 kg flour, can buy 10-10 kg flour from him.

But now if every person comes to more 100-100 rupees and wants to buy flour with his all money but the shopkeeper has a certain quantity of flour, then what will happen that the shopkeeper will increase the price of flour. And as many people were buying in the first 100 rupees. They will now be forced to buy for 200 rupees. Therefore, this increase in price is also called inflation.

Inflation can occur due to many reasons, some of the main reasons are as follows -

Increase in public expenditure - Due to an increase in public expenditure, the amount of money with the public increases, and the demand for spending money becomes more. The value of the currency falls as demand increases and production relaxes.

Production Supply - Inflation increases due to a decrease in production and hoarding of shopkeepers as demand in the market increases and production decreases.

Indirect Taxes - Indirect taxes levied by the government increase the cost price which is a factor in the increase in the value of goods.

Population growth - Population growth is also a major factor of inflation because the increase in population also increases demand.

Liquidity in interest rates - If there is a reduction in interest rates by the bank, then there will be more money spread in the market. That is, people can borrow more money due to lower interest rates.

Increase in Salary - Increase in the salary of employees but not an increase in total production in the same proportion is also a factor of inflation.

Increase in imports - Due to an increase in imports, the country's currency goes out, for which the government needs to print more currency. Excessive currency issuance increases currency circulation.

Producing more money to supply deficit budget by the government.

Increased prices in the international market.

Increased demand more than production.

Thus we can understand that inflation can happen due to many reasons.

By boosting production - The minimum support price on food items can be announced by the government to boost production. This will increase production and the value of goods will not increase much.

By enacting stricter laws against hoarding and black marketing - If the government takes a strict stand against hoarders and black marketers, then the availability of goods in the market will remain and the value of goods will also remain constant.

Through Monetary Policy - We can balance the amount of money by monetary policy. The country's monetary policy is determined by the RBI. Therefore, RBI can control inflation by balancing the amount of money through monetary policy.

Demonetization - Demonetisation is also one of the main ways to control inflation. If the government fails to control inflation, it can resort to demonetization. In demonetization, the government starts circulation of the new currency instead of the old currency, so that the amount of inflation can be controlled.

By Increasing interest rates -The excess in interest rates can decrease the demand because the market rate will decrease if the interest rate is increased and demand will remain stable.

By Reducing imports - due to a reduction in imports, the country's currency will remain in the country, so that the government will not need to print more currency.

On the contrary, the government can provide employment opportunities by not spending more money through government schemes.

By increasing taxes like income tax and VAT by the government.

By reducing the budget deficit

By increasing production.

Reducing expenditure by encouraging savings.

Inflation can be determined by two methods. Wholesale Price Index and Consumer Price Index.

Wholesale Price Index - Under the wholesale market, changes in wholesale market prices are seen. It only measures the change in the value of goods.

The wholesale price index is used to measure inflation in India.

Consumer Price Index - Under the Consumer Price Index, the prices paid by consumers on goods and services are measured on the basis.

There may be several stages of inflation depending on the symptoms and intensity. like -

When the general price level rises very slowly, it is called crawling inflation.

When the normal price increases by 5 - 10% annually, it is called moving or running inflation. This situation is a warning signal for governments to take measures to avoid inflation reaching 2 digits.

When the normal price level starts increasing at a rapid pace and the increase reaches 10 - 20% per annum, it is called Bouncing inflation.

When the inflation rate exceeds 20%, it is called a situation of Extreme inflation. In this situation, inflation goes out of control because it rises very quickly in a very short period of time.

Probably we all think that only loss is caused by inflation but this is not always necessary. Inflation affects different classes of people differently. The effects of inflation are as follows -

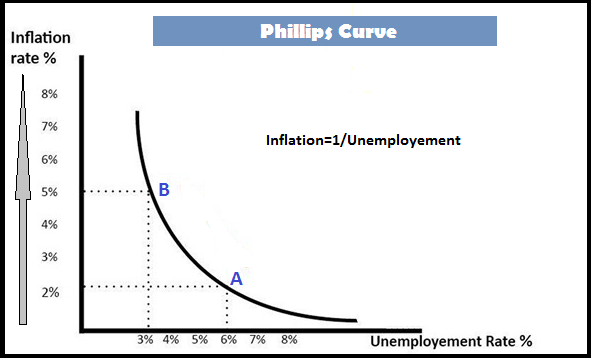

In 1958, CW Phillips proposed a curve called the Phillips curve to demonstrate the relationship between inflation and the unemployment rate. The Phillips curve shows the inverse relationship between inflation and the unemployment rate. That is, the higher the rate of inflation, the lower the unemployment rate, and the higher the rate of employment. That is, an increase in employment cannot be done without increasing the rate of inflation. In relation to the Phillips curve, Milton Freedman proposed that such a relationship is only short-lived. In the long run, this relationship does not happen and that does not affect the increase in the rate of inflation on employment, that is, there remains a level of unemployment that will remain in the state of full employment. It is called the Unemployment rate in full employment or natural rate of unemployment.

Deflation is the absolute opposite of inflation. Just as inflation is a typical stage of the rise in the price level, similarly in currency deflation, the value of the currency declines.

When production increases in the economy, the number of goods and services increases. When the production of goods and services increases compared to monetary income, the value of the currency starts to fall. The price of goods falls and the goods do not sell even if they are cheap, this situation is called recession/deflation.

Deflation has more adverse effects than inflation, as production is reduced to deal with a recessionary situation which also leads to loss of employment.

The situation in which both inflation and deflation are present is called Stagflation.

In the general sense, we can understand that inflation is called due to an increase in the value of goods and a decrease in the value of the currency. Inflation in developing countries persists. The government of the country should be prepared to deal with this situation efficiently.

It is necessary to periodically analyze the situation of inflation in the country. The influence of inflation can be dealt with by a good finance system and monetary policy. Currently, the inflation rate in India (in 2020) based on the Consumer Price Index is 7.59%.